Alert blog reader Michael Zall drew my attention to the following numbers which are easy to pull from the TESS database on the web site of the USPTO. The table shows year-on-year comparisons for new US trademark filings during particular date ranges. Compare March 2020 with March 2019, for example, and the number of new US trademark filings is down 14%.

| Jan 1 to April 15 | March 1 to March 31 | |

| 2019 | 140753 | 43911 |

| 2020 | 126502 | 37608 |

| percent drop | 10% | 14% |

This observed drop is consistent with some slides that the USPTO trademark management presented to the Trademark Public Advisory Committee last Friday, as I will now discuss.

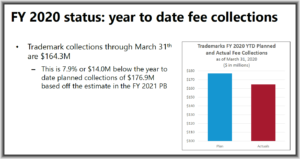

Last Friday there was a meeting of the TPAC, and these slides were presented. This is from slide 25. It says that trademark-related fee collections for fiscal year 2020 are down 7.9%. Keep in mind that the fiscal year began October 1, 2019, so the red bar in the chart is a blend of healthy economy for the closing three months of calendar 2019 together with the first few months of 2020.

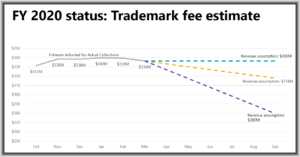

This puts USPTO trademark management in the unenviable position of trying to guess what might happen in coming months. Here is slide 26.

I had to smile, though, at the ways that these charts had been prepared. You might wonder what mathematical model was employed to generate the violet line that ends at $280 million. The legend helpfully explains that the way that this violet line was generated was by drawing a line to the point at the end of FY 2020 that is at $280 million. In other words you assume that the revenue by the end of 2020 will be $280 million and you draw a straight line from the last number that you actually know, down to that end point that is $280 million, and that is how you get the violet line. Or if you assume that the revenue by the end of 2020 will be $318 million and you draw a straight line from the last number that you actually know, down to that end point that is $318 million, and that is how you get the yellow line.

Looking at the graph, a person can sort of guess where the $318 million came from. Maybe what happened is someone took the revenue drop from February 1 to March 1 and assumed that the slope would remain constant for the remaining six months of the fiscal year. And a person can guess that the source of the $336 million was that someone took the projected entire-year revenue based on what had happened by March 1, and assumed things would not worsen for the remaining six months of the fiscal year. But the $280 million number? As I say as far as one can tell from this slide, the number was picked out of the air. And then somebody simply drew a straight line from the last-known actual number down to the place where you hit the number that was pulled out of the air, namely $280 million.

The other thing that I hope the members of the TPAC were alert enough to realize was that the person preparing these two charts did the usual tricky thing that people do when they are being tricky when they are preparing charts — they did not start the Y axis at zero. In the bar chart with the blue bar and the red bar, the Y axis starts at $100 million. This makes the visual impact of the revenue drop, as portrayed in the bar chart, more than double its actual mathematical impact.

The line graph does this in an even more extreme way, starting the Y axis at a quarter of a billion dollars. This makes the visual impact of the violet line widely out of proportion to actuality. The TPAC committee member who sees this slide flash past in a few seconds might be forgiven for taking away that the Trademark Office was worried about maybe losing more than half of its revenue stream by the end of FY 2020, when the true impact being worried about was far, far smaller than that.

Now I get it that there is a drop in new trademark filings. Our alert blog reader was able to figure that one out. And I get it that a drop in new trademark filings will reduce fee collections. And I get it that this injects some uncertainty in the planning for Trademark Office management. But it’s a bit disappointing to see tricks like these in the graphs.